Welcome to a deep dive into the essential components required to navigate the SBA 7a loan process efficiently. Whether you're looking to acquire a business or expand your current operations, understanding the items needed for a successful application is crucial. In this article, we’ll break down the requirements, the application process, and some strategic insights to help you secure financing with ease.

Understanding SBA Loans

The Small Business Administration (SBA) offers loan programs designed to assist small businesses in obtaining financing. Among these, the SBA 7a loan is one of the most popular options for business acquisitions. It allows borrowers to secure up to 90% financing for purchasing an existing business. This is a significant advantage for entrepreneurs looking to minimize their initial capital outlay.

Items Needed to Process an SBA Loan

To successfully process an SBA loan, particularly for business acquisitions, you'll need to gather several key documents:

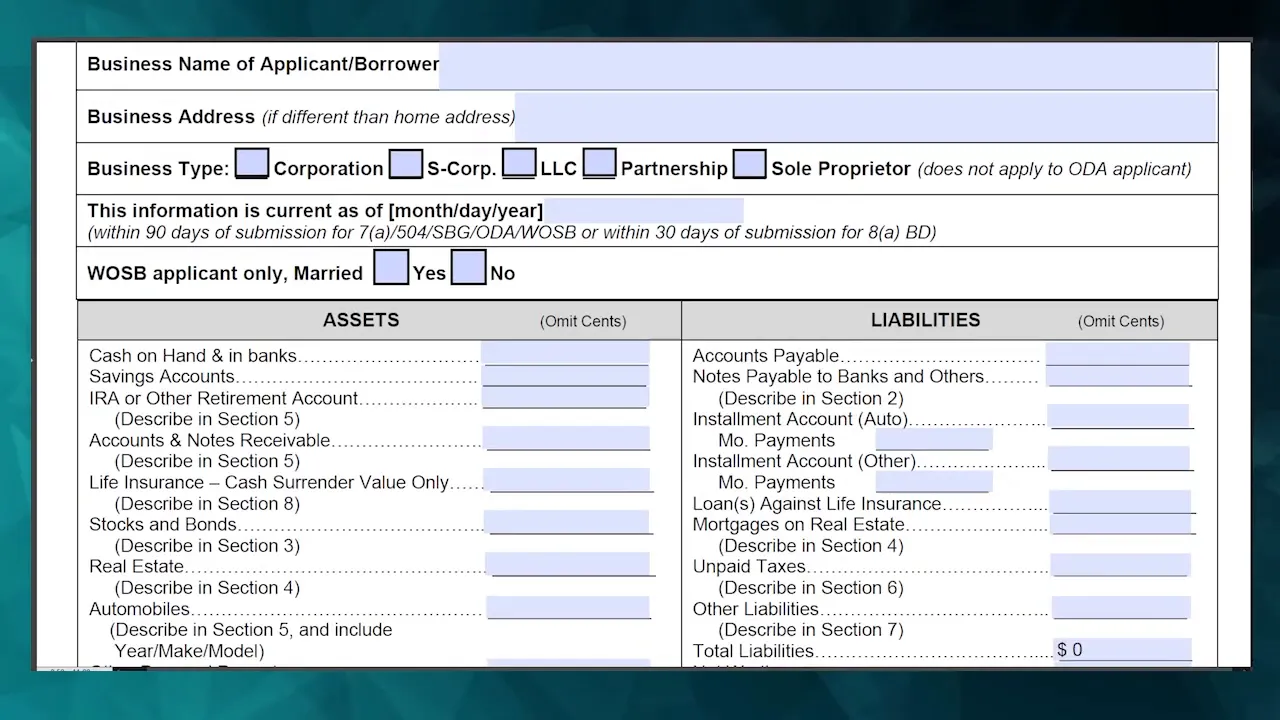

- Form 413: This is a personal financial statement that outlines your financial status.

- Debt Schedule: A complete breakdown of any existing debts.

- Application: A formal application for the loan.

- Resume: Your professional background and experience.

- Projections: Financial forecasts for the business you intend to purchase.

In addition to these documents, you will also need:

- Purchase and Sale Agreement: A formal agreement between you and the seller.

- Seller’s Financials: Financial statements from the seller for the past three years, including a year-to-date interim statement.

The Application Process

Once you have collected all necessary documents, you can begin the application process. Typically, the timeline from document submission to receiving a commitment letter from the bank is about 10 to 14 days. However, if you have all your documentation ready, you could expect the SBA 7a loans to close within 60 days.

It’s important to note that complexities such as real estate appraisals may extend this timeline. If you’re buying a business that includes real estate, additional steps will be involved in the appraisal process.

Utilizing a Documentation System

To streamline the application process, consider using a systematic approach to manage your documentation. I recommend using a platform that allows you to download, complete, and upload the required forms efficiently. This will not only save time but also reduce the chances of missing important documents.

Starting a Business vs. Acquiring an Existing One

It’s essential to differentiate between acquiring an existing business and starting a new one. If you're starting a business, the requirements change significantly. Since you won’t have existing financials to present, you’ll generally be looking at a lower loan-to-value (LTV) ratio, typically between 80% and 85%.

For startups, a more detailed business plan is required. This plan should outline your strategies and projections for the next three years, as you won't have a proven track record to rely on.

Hard Assets vs. Intangible Assets

When acquiring a business, it’s crucial to understand the distinction between hard assets and intangible assets. Hard assets include physical items like real estate and equipment, while intangible assets might include brand value or customer lists.

The SBA 504 loan is specifically geared towards financing hard assets. However, it won't cover any intangible assets. Therefore, if you're considering a 504 loan for real estate, you may need a companion 7a loan for the intangible portions.

Financing for Business Expansion

Beyond acquisition, the SBA loan can also be utilized for business expansion. If you already own a business and are looking to grow, some preferred lenders offer up to 100% financing for expansion projects. This can be a game-changer for existing owners looking to invest in additional facilities or services.

For instance, if you own a self-storage facility and wish to acquire another, you could leverage SBA financing to cover the entire cost of that expansion.

Conclusion

In summary, successfully navigating the SBA 7a loan process requires a clear understanding of the necessary documentation and the differences between business acquisitions and startups. By preparing your financial statements, business plans, and understanding the distinctions between hard and intangible assets, you can position yourself for a successful loan application.

If you're looking for more personalized guidance, feel free to book a discovery call with me. Together, we can develop a strategic finance plan tailored to your unique business goals.

For more insights and updates, make sure to subscribe to the Investor Financing Podcast. Let’s work together to turn your business dreams into reality!