Welcome to our latest update on SBA Loan Rates for May 2025! In this article, we’ll delve deep into the current SBA 504 rates, recent guideline changes, and what these developments mean for business owners and entrepreneurs looking to finance their ventures. As always, we aim to provide you with valuable insights to help you make informed decisions.

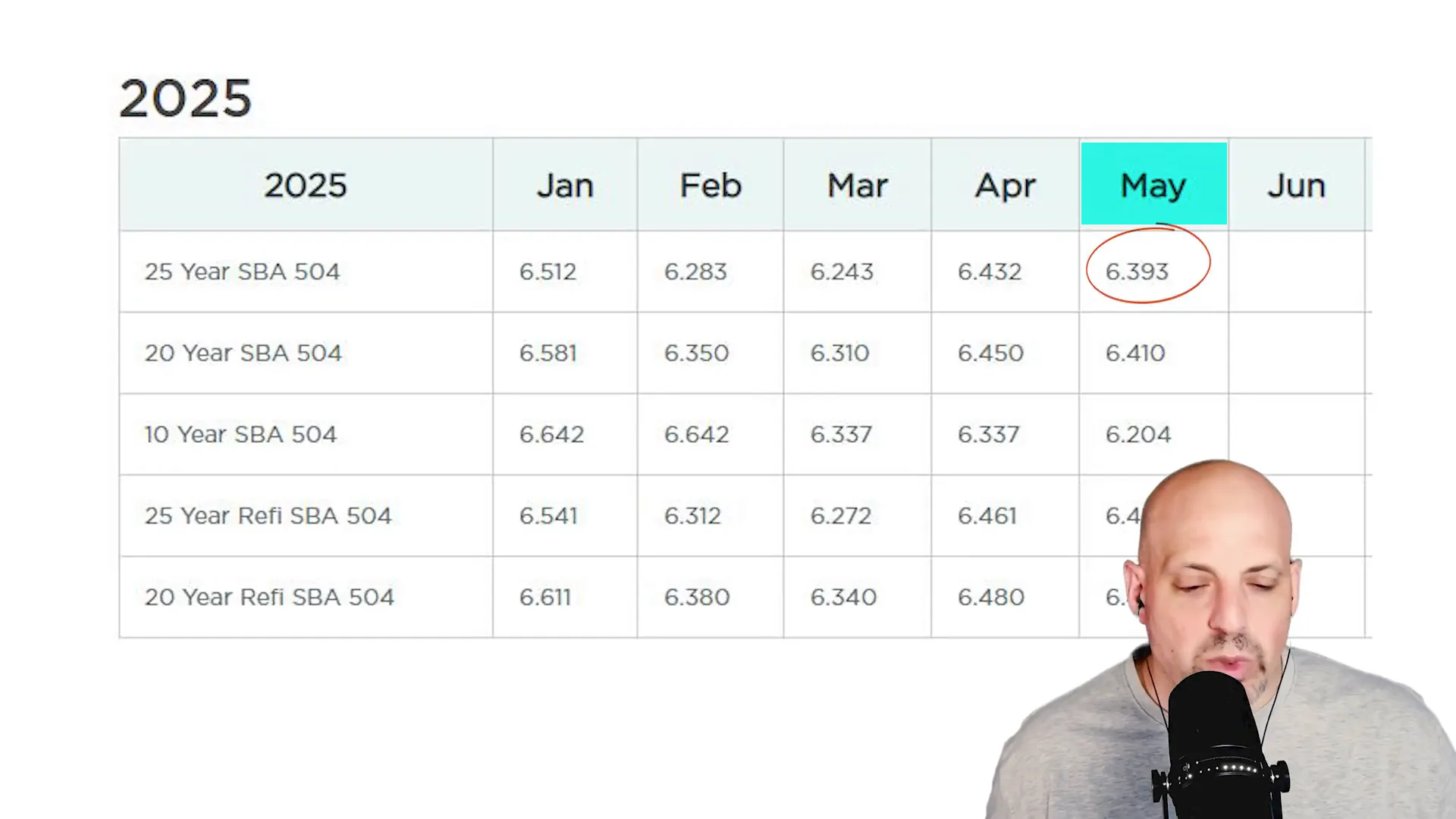

Current SBA 504 Rate: 6.393%

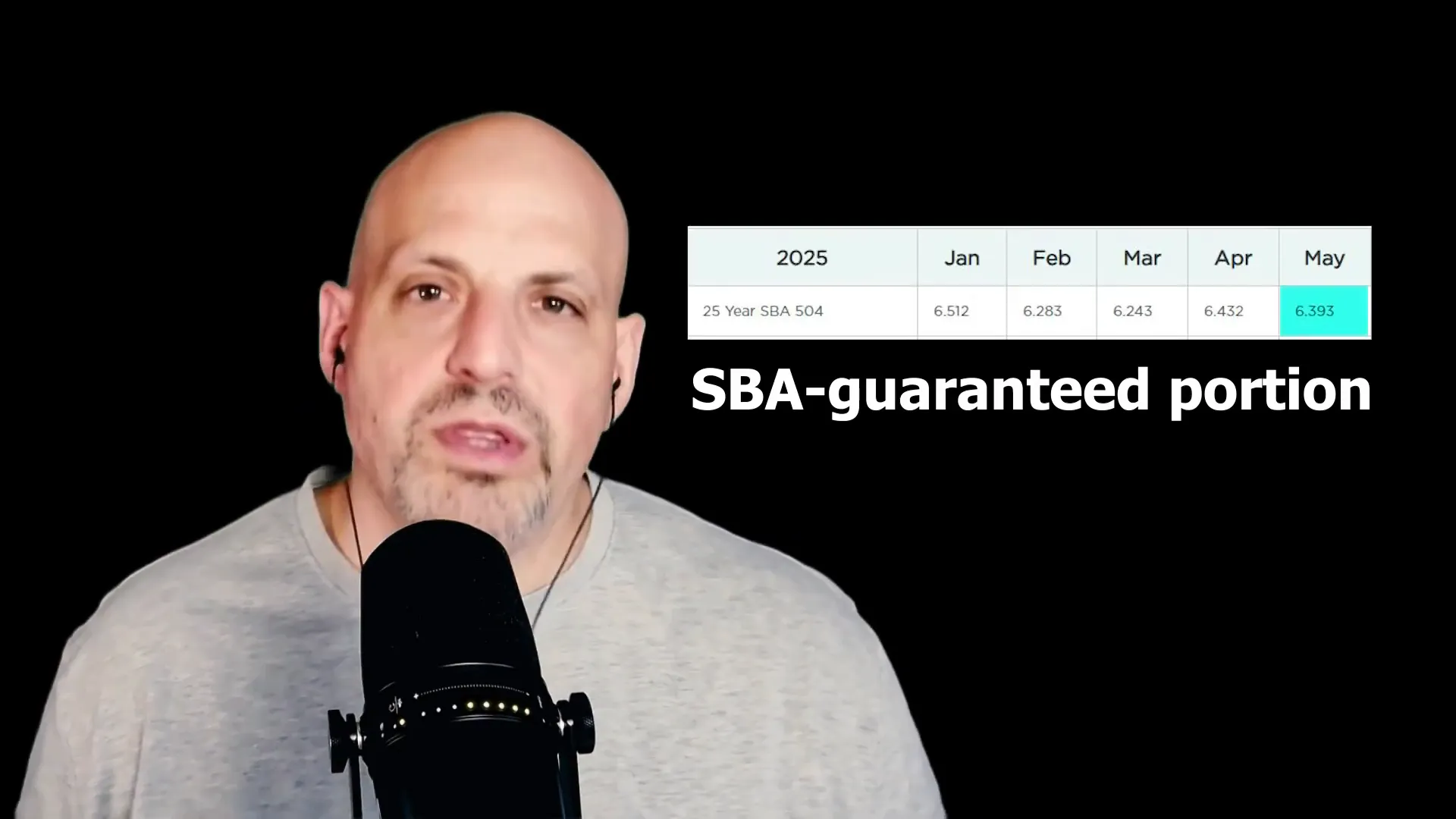

As of May 2025, the SBA 504 rate stands at 6.393%. This is a slight decrease from last month, where the rate was recorded at 6.432%. Understanding the current rate is crucial for entrepreneurs looking to secure financing for their business projects. The SBA 504 loan program involves two loans: a first mortgage and a second, which is the guaranteed portion.

Understanding the SBA 504 Structure

The SBA 504 loan program is designed to help small businesses acquire fixed assets for expansion or modernization. The structure is unique because it consists of two loans:

- First Loan: This is a conventional loan provided by a lender, covering up to 50% of the project cost.

- Second Loan: This is a government-backed loan, which is guaranteed by the SBA and can cover up to 40% of the project costs.

With this structure, the borrower is responsible for a down payment of at least 10%. This arrangement allows businesses to access substantial financing while keeping their cash flow manageable.

Recent Changes in SBA Guidelines

Recent updates to the SBA guidelines have reverted back to many old rules, particularly affecting loans under $500,000. One significant change is the tightening of credit score requirements:

- The minimum credit score has increased from 155 to 165 for eligibility.

These adjustments aim to ensure that borrowers are more financially stable, which can be both a positive and a negative for potential applicants. Stricter credit requirements may limit access for some entrepreneurs but may also enhance the quality of borrowers.

Potential for Larger Financing Deals

One of the most exciting developments in the SBA landscape is a proposal related to manufacturing businesses. If passed, this proposal would allow manufacturing companies to access up to $10 million in aggregate SBA 7A or 504 financing. This means:

- The second piece of the 504 loan could be as high as $10 million.

- In theory, this could lead to $30 million or even $40 million SBA 504 deals being completed in a single transaction.

This change has the potential to revolutionize financing options for larger deals, particularly in the manufacturing sector, which is often capital-intensive.

Why SBA is Still the Best Financing Tool

Despite some of the negative changes, the SBA remains the premier financing tool for entrepreneurs. Here’s why:

- Access to Capital: SBA loans provide access to larger amounts of capital than traditional loans.

- Longer Terms: SBA loans typically offer longer repayment terms, which can ease financial pressure.

- Lower Down Payments: The down payment requirements are lower compared to conventional financing.

This makes SBA loans an attractive option for those looking to buy businesses, start new ventures, or fund construction projects.

Structuring Custom Loan Packages

Finding the right financing structure can be challenging. At our firm, we specialize in helping clients navigate the complexities of various financing options. Whether you’re considering:

- SBA 7A

- SBA 504

- USDA loans

We can help you determine which option is best for your unique situation. Our expertise allows us to work closely with top business development officers (BDOs) who specialize in these programs, ensuring that your loan package is structured effectively.

Finding Your Ideal Business

In addition to financing, we also assist clients in finding their ideal business opportunities, particularly in the franchise space. Whether you're looking to:

- Start a new franchise

- Purchase a franchise resale

We have a wide array of options available, and we can help you create a game plan that aligns with your business goals. Our internal inventory includes various franchises throughout the nation, making it easier for you to find the right fit.

Resources for Business Growth

If you're looking to grow your business organically without incurring massive overhead, I’ve put together a free ebook that focuses on utilizing virtual team members and AI to maximize production. This resource is designed for entrepreneurs who want to scale their operations effectively.

To get your free copy, visit biscalingplaybook.com. It's packed with tools, prompts, and strategies to help you grow your business efficiently.

Conclusion

In summary, the SBA Loan Rates for May 2025 present both challenges and opportunities for entrepreneurs. With the current SBA 504 rate at 6.393%, recent guideline changes, and exciting proposals for larger financing options, now is a pivotal time to explore your financing options.

Whether you're looking to finance a new business acquisition, secure funding for an expansion, or find the right franchise opportunity, we are here to help. Don't hesitate to reach out for personalized assistance and guidance tailored to your unique needs.

For more insights and updates, feel free to subscribe to our channel, where we discuss all things financing. Thank you for reading!