If you’re a business owner or entrepreneur looking to finance your next project, staying updated on SBA loan rates is crucial. I’m Beau Eckstein, your Business Ownership Coach, bringing you the latest insights on SBA 504 rates for July 2025. In this comprehensive guide, I’ll break down what the current rates mean, compare SBA 504 and 7A loans, and share expert tips on securing the best financing for acquisitions, construction, startups, and more. Whether you’re new to SBA loans or a seasoned borrower, this article will help you make informed decisions to scale your business efficiently.

Photo by Christian Dubovan on Unsplash

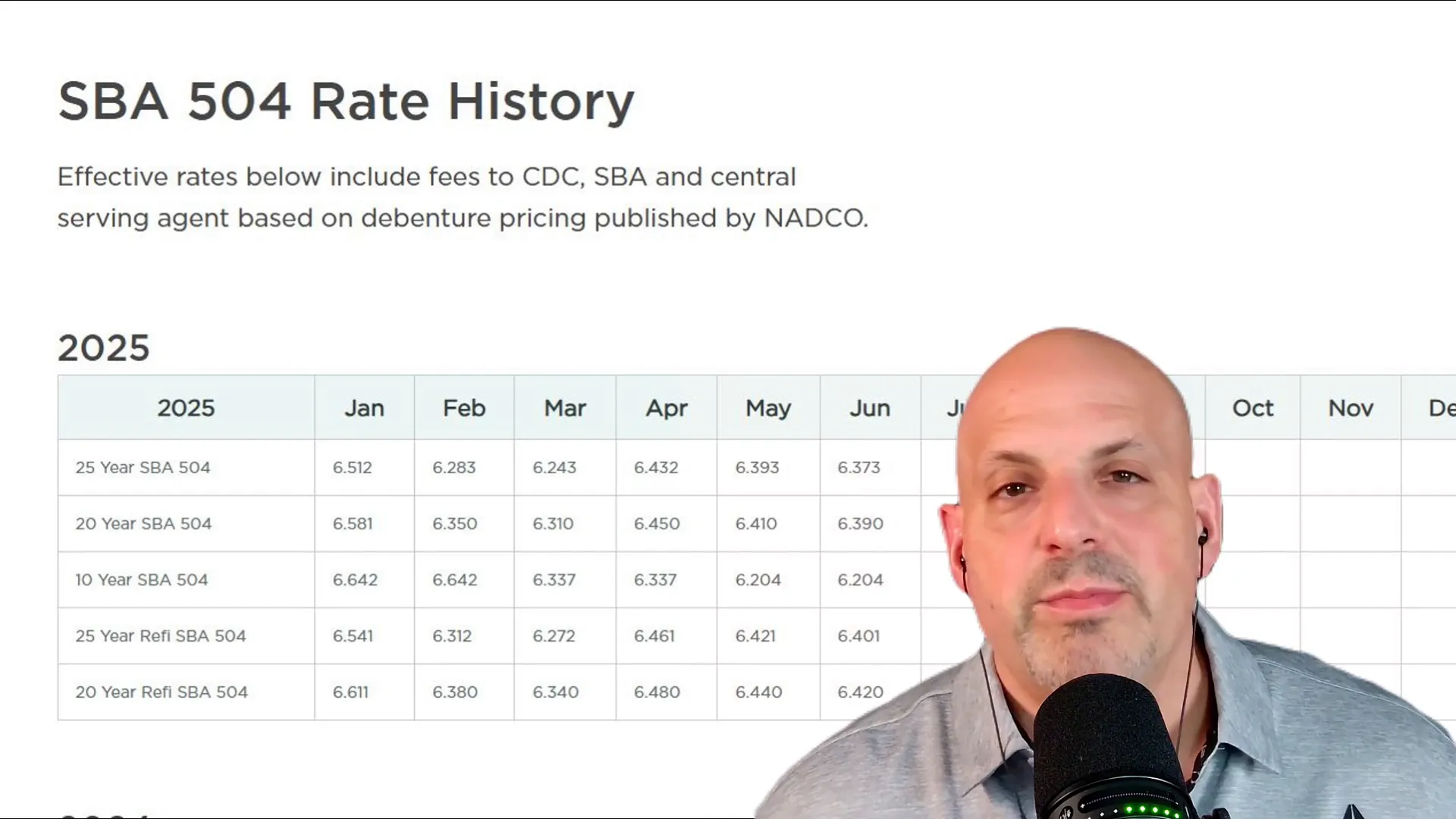

July 2025 SBA 504 Loan Rate Update

For July 2025, the SBA 504 loan rates remain steady, with the 25-year debenture rate holding at 6.37%. This is the same rate as last month, reflecting a period of relative stability in the market. The good news is that the rates haven’t swung dramatically either up or down in recent months, which provides some predictability for borrowers planning their financing strategies.

Based on current trends, I anticipate a gradual downward movement in rates over the coming months. However, I don’t expect any sharp declines. Instead, the rate may step down slowly, allowing businesses to capitalize on improving loan terms as the market adjusts.

Understanding the SBA 504 Loan Structure

The SBA 504 loan program is unique because it essentially consists of two loans: a first and a second lien. When we talk about the 25-year debenture rate of 6.37%, we’re specifically referring to the guaranteed portion of the loan, which is the second lien. This structure makes the SBA 504 loan especially attractive for certain types of financing, particularly for real estate and asset-based lending.

By contrast, SBA 7A loans operate differently. Their rates are typically tied to the Wall Street Journal Prime Rate plus a margin. For business acquisitions, SBA 7A loans usually have a 10-year term. But when real estate comprises a larger part of the purchase price, 7A loans can sometimes be structured over 25 years, similar to the SBA 504’s term. This flexibility often raises the question: Which is better, SBA 7A or SBA 504?

SBA 7A vs SBA 504: Which Loan is Right for Your Project?

The answer depends on several factors, including your total project cost, the nature of your business, and your financing goals. SBA 504 loans are primarily geared towards asset-based lending — they work well when you have tangible assets like real estate or equipment to secure the loan.

On the other hand, SBA 7A loans offer more versatility. They can be used for asset-based lending, but also allow for “blue sky” financing, which means you can finance goodwill or business acquisitions without collateral. This makes SBA 7A loans a better fit for startups or businesses without significant physical assets.

When evaluating rates, it’s important to consider the credit quality of your deal. For example, SBA 7A loans for AA+ rated deals currently have rates in the high 5% range, which is below the prime rate. Some banks even offer below prime margins, such as prime minus one or prime minus half a point, on commercial real estate deals financed with SBA 7A. These attractive rates are generally reserved for low-risk, well-established businesses with strong financials.

Current Rate Trends and Market Insights

As of now, the Wall Street Journal Prime rate, which SBA 7A loans are tied to, has remained stable, and the SBA 504 debenture rate is unchanged at 6.37%. This stability is a positive sign for borrowers seeking to lock in financing without worrying about sudden rate hikes.

We continue to see a variety of SBA lending activity across different sectors — from construction loans to franchise financing, business acquisitions, and startups. SBA loans remain one of the most versatile financing tools available, with options tailored to fit many business needs.

Large SBA Deals and Future Loan Limits

Another exciting development is the potential increase in SBA 7A loan limits. Currently, SBA 7A loans are capped at $5 million, but there is ongoing movement to raise this limit to $10 million. If approved, this change will open the door for much larger deals, especially when combined with SBA 504 financing.

Right now, SBA 504 loans can be structured with a first and second lien, allowing total deal sizes to reach $12 million, $13 million, and sometimes even $20 million or more, depending on the senior loan amount. This is particularly beneficial for businesses looking to finance significant real estate or equipment investments.

With the potential new limits, the SBA financing landscape will become even more powerful, enabling “monstrous” deals that were previously out of reach for many small and mid-sized companies.

Key Differences: SBA 504 for Asset-Based Lending vs SBA 7A for Blue Sky and Goodwill

It’s important to understand the fundamental difference between SBA 504 and SBA 7A loans beyond just rates and terms. SBA 504 loans are primarily designed for asset-based lending — meaning the loan is secured by physical assets such as commercial real estate or equipment.

SBA 7A loans, however, offer more flexibility. They can be used for asset-based lending, but also for “blue sky” financing — which includes intangible assets like goodwill or business acquisitions without collateral. This makes SBA 7A loans ideal for startups or businesses that may not have significant physical assets but have strong business potential and financial backing.

Choosing the right loan product depends on your business stage, asset base, and financing goals. If you have questions or want to explore options, I’m here to help guide you through the process.

How to Get Your SBA Loan Priced and Customized for Your Business

If you’re interested in getting a loan priced out or want personalized advice on SBA financing, you can easily book a free funding strategy call with me at bookwithbeau.com. I’m happy to discuss your specific situation, walk you through the loan options, and help you secure the best possible terms.

Whether you’re financing a startup, acquiring a business, or investing in commercial real estate, SBA loans offer unmatched versatility and value. Don’t hesitate to reach out and explore how these programs can work for you.

Boost Your Business Growth with Virtual Assistants and AI

In addition to financing, scaling your business efficiently requires smart systems and tools. I’ve put together a free ebook that reveals how to supercharge your productivity, build scalable operations, and close more deals using virtual assistants (VAs) and artificial intelligence (AI).

In this exclusive guide, you’ll learn:

- Strategies to boost your productivity

- How to build scalable systems that grow with your business

- Techniques to close more deals consistently

These proven methods have helped me transition from doing everything myself to leading a high-performing, automated team. To get your free copy and unlock these secrets, visit bizscalingplaybook.com.

Stay Connected for More SBA Lending Insights

If you found this guide helpful, I encourage you to subscribe to my channel where I share regular updates on all things SBA financing and business growth strategies. With over 20 years in the lending industry, I’m committed to providing valuable content and answering your questions to help you succeed.

Remember, whether you’re exploring SBA 504 loans, SBA 7A loans, or other financing tools like USDA or BNI loans for rural businesses, staying informed is your best advantage.

Thanks for reading, and I look forward to helping you scale your business with the right financing solutions!