I’m Beau Eckstein — Business Ownership Coach and host of the Investor Financing Podcast — and in this post I explain a powerful financing strategy I cover on the show: Pari Passu SBA loans. If you’ve ever hit the SBA 7(a) cap and wondered how to fund an acquisition north of $5 million, this guide walks you through what Pari Passu means, how it works alongside SBA 7(a) and conventional financing, what lenders want to see, and practical steps to get a complicated deal closed.

What is a Pari Passu SBA Loan?

Photo by Giorgio Tomassetti on Unsplash

Pari Passu (Latin for “equal footing”) in the context of SBA lending refers to a split-lender structure where two loans sit side-by-side with equal lien rights. Practically, that often looks like an SBA 7(a) loan at the SBA cap (currently $5 million) combined with a conventional loan (often $1M–$3M or more) from the same lender to cover the remaining purchase price and working capital.

When structured Pari Passu, both loans are effectively in the same position—first lien—so if a default occurs, the lender has equal rights across the collateral for both loan pieces. Because the SBA only guarantees the government-backed portion, the conventional piece is not guaranteed and represents the lender’s unprotected exposure.

Why this matters

Pari Passu gives buyers the ability to acquire businesses far above the SBA single-loan cap without waiting for legislative increases or navigating multiple, independent lenders. For many growth-minded entrepreneurs, this is the difference between walking away from an opportunity and getting to the finish line.

How Pari Passu Differs from SBA 7(a) and 504 Loans

SBA 7(a) loans are flexible acquisition loans with a government-guaranteed component. SBA 504 loans are geared more toward long-term real estate and large fixed-asset purchases and require a certified development company (CDC) participation. Pari Passu blends the 7(a) guarantee piece with an unguaranteed conventional tranche.

Reasons banks and borrowers choose Pari Passu over an SBA 504 structure include speed, lender comfort with 7(a) underwriting, and complications tied to 504’s additional participants and process length. In deals with real estate, some banks prefer to use a 7(a) + conventional split rather than involve a CDC. That said, not every bank will entertain a Pari Passu structure.

Does Pari Passu Require Real Estate?

No—Pari Passu transactions can be done without real estate, but they are far more common and easier to place when real estate is involved. The reason is simple: real estate provides collateral that secures both loan pieces. Without property, the conventional tranche becomes higher risk for the lender because it lacks a government guarantee.

In practice, I work with about four banks that will regularly structure non-real-estate Pari Passu deals. The rest tend to offer Pari Passu only when real estate secures the transaction. If there’s a shortfall in collateral on a non-real-estate deal, lenders will look for other assets—personal residences, rental properties, or strong cash flows—to mitigate risk.

Why Most Lenders Avoid Pari Passu

Photo by Vitaly Gariev on Unsplash

From a lender’s perspective, Pari Passu is inherently riskier. Lenders are often asked to write a conventional, unguaranteed chunk that could represent 20%–40% or more of the total acquisition financing. If the business fails, the conventional piece has no federal guarantee, meaning recovery depends entirely on collateral and collection efforts.

The underwriting bar is therefore higher. Banks demand strong cash flow, conservative projections, a believable business plan, and often significant borrower experience. When collateral is thin, lenders want other strong mitigants—solid liquidity, investor partners, or a seller who is cooperative during closing and transition.

How to Get a Pari Passu Deal Funded: Steps and Pitfalls

Getting a Pari Passu deal done requires careful preparation. Here’s the step-by-step approach I take with clients:

- Pre-underwrite the file: Identify weak spots early—collateral shortfalls, projection assumptions, or gaps in borrower experience—and shore them up before going to underwriting.

- Engage the right banks: Not every lender will touch these deals. Work with lenders experienced in Pari Passu or those willing to structure both loan pieces.

- Secure internal champions: You often need support from the SBA division head and sometimes final sign-off from the bank’s head for larger deals.

- Bring credible equity and working capital: Lenders want to see meaningful borrower skin-in-the-game and sufficient liquidity post-close to weather the first months.

- Get seller cooperation: Especially in large or thin-collateral deals, a seller who wants the deal to close will help resolve purchase agreement contingencies and transition items quickly.

Pitfalls to avoid include underestimating lender appetite for unguaranteed exposure, presenting incomplete collateral schedules, and neglecting to clearly document cash flow drivers. Tighten the “leaks” in your package before pitching the file.

Photo by Vitaly Gariev on Unsplash

Case Study: Saving a Stalled $10M Acquisition

Here’s a real example I worked on: a $10 million acquisition where two major SBA lenders passed. The file was clean from a cash flow standpoint but had very little collateral. The borrower had $300,000 of his own capital and an investor partner who contributed $700,000, together roughly 10% of total project cost. We structured a $5 million SBA 7(a) and a $2.2 million conventional Pari Passu piece, plus working capital.

Why this succeeded where others failed:

- We preemptively tightened weak links and built a complete collateral and cash-flow story.

- We worked with a bank that could underwrite both loan pieces and had internal buyers for larger deals.

- The borrower had a cooperative seller and credible management plan, which increased lender confidence.

That level of preparation earned us the SBA division head’s support and ultimately the bank head sign-off required to fund the transaction.

Preparing Your Deal: A Practical Checklist

Before you approach lenders for a Pari Passu structure, make sure you have:

- Accurate historical financials and a conservative 12–24 month projection model.

- A complete collateral schedule and documentation for any additional assets you can pledge.

- Evidence of sufficient working capital post-close (lenders like to see liquidity set aside).

- A credible management plan and, if possible, seller transition support.

- Introductions to lenders known to structure Pari Passu deals—or an adviser who can open the right doors.

Outlook and Final Thoughts

Pari Passu deals are not for everyone. They demand disciplined underwriting, strong cash flow, and a lender willing to assume unguaranteed risk. That said, as SBA loan caps and program rules evolve—there’s discussion in the industry about raising caps for certain sectors like manufacturing—you’ll see more creative, split-lender financings emerge.

If you’re considering an acquisition that’s larger than the SBA 7(a) cap or you’ve been told your deal is “too big,” don’t assume the door is closed. Work with experienced advisers and lenders who understand pari passu structures and can prepare your file to succeed.

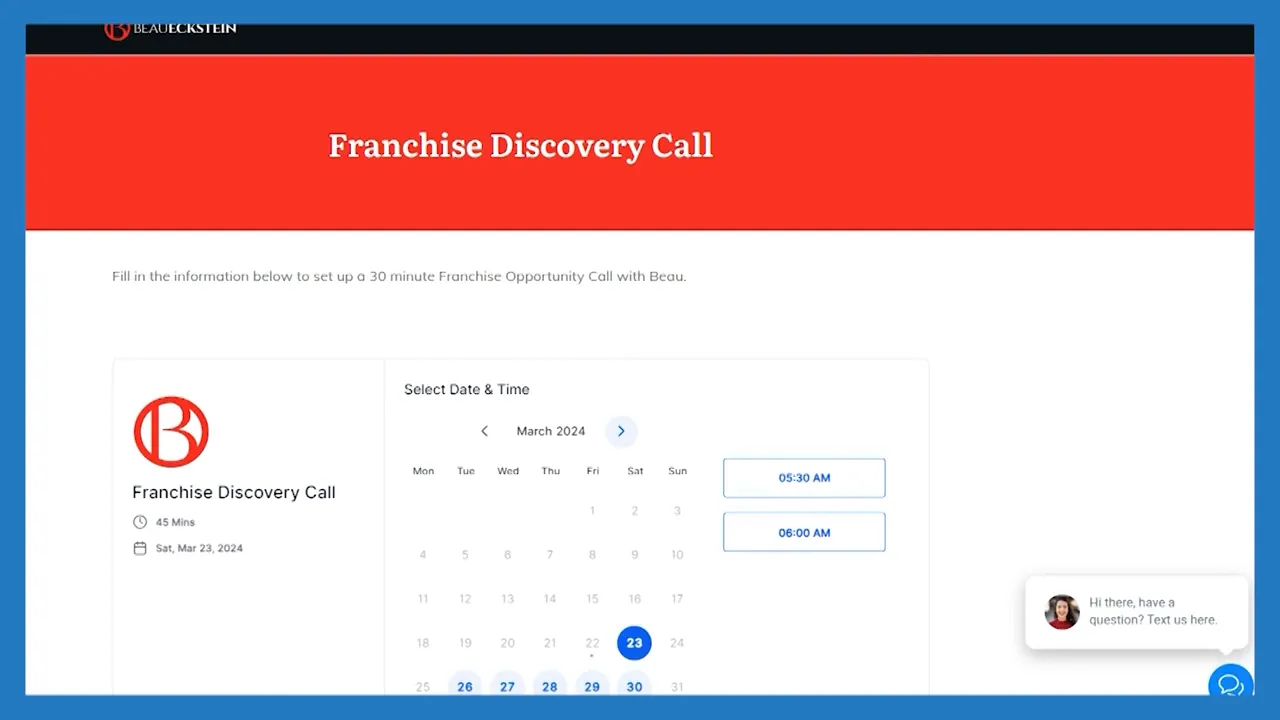

Next Steps — How I Can Help

If you want hands-on help navigating a Pari Passu transaction or assessing lender appetite for a complex acquisition, book a call with me. I help entrepreneurs structure the financing, present clean files, and identify the banks that will actually get these deals done.

“Take the time to plug any possible leaks in the boat before you present to an underwriter.” — Beau Eckstein, Business Ownership Coach | Investor Financing Podcast

Ready to move forward? I’ve walked clients through deals that were previously stalled and gotten commitments where others failed. Whether you need help preparing a package, identifying lenders, or negotiating seller cooperation, I can help you get to the finish line.

Business Ownership Coach | Investor Financing Podcast