Hi, I'm Beau Eckstein — Business Ownership Coach | Investor Financing Podcast — and in this article I break down what lenders actually look for when it comes to collateral on SBA 7(a) loans, especially if your business has limited tangible assets. I'll walk you through the rules, practical structuring strategies, and creative equity sources so you can optimize your application and avoid common underwriting pitfalls.

Equity Injection Requirements: What the SBA Says vs. What Lenders Do

The SBA allows substitution of collateral in certain situations, but reality in the marketplace is different: most banks are conservative and prefer seeing a clear equity injection. For an SBA 7(a) acquisition, the classic structure is loan-to-cost with the buyer injecting the gap between the total project cost and the SBA-backed portion.

Here's a simple example to illustrate the math and expectations. Assume a business acquisition totals $1,000,000 and the business cash flow supports a $900,000 SBA 7(a) loan. That leaves $100,000 of required equity (the 10% gap). The key point: lenders want to see the equity in the deal and documented in a way that underwriting accepts.

While SBA guidance contains mechanisms like substitution and seller standby notes, many banks prefer to see tangible demonstration of equity — either cash at closing, seller financing structured in an SBA-compliant way, or an outside equity contributor. Knowing how your lender interprets guidelines will shape which approach you use.

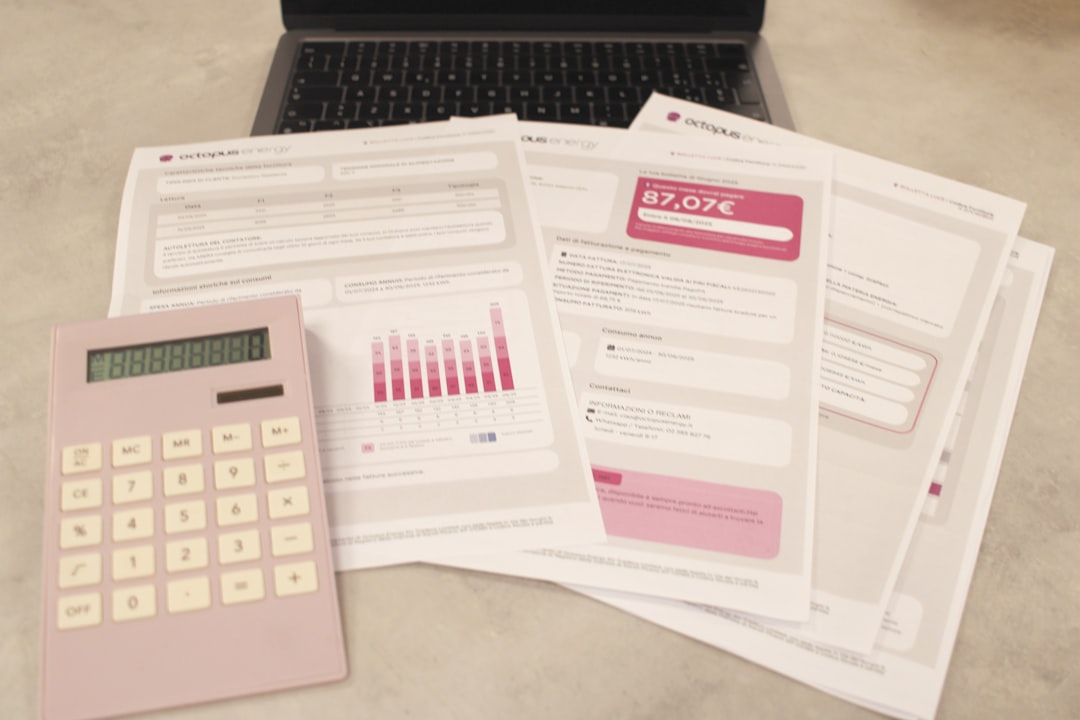

Photo by Vitaly Gariev on Unsplash

Seller Financing Strategy: How a Standby Carryback Can Count as Equity

One of the most powerful tools in acquisition financing is seller financing. If the seller is willing to carry a note on standby — particularly a full standby — that can effectively act as equity for SBA underwriting. A full standby typically means the seller's note is subordinate and no payments are required for a defined initial period (often two years).

Using the earlier example, if the buyer needs $100,000 equity and the seller agrees to carry $75,000 on full standby (no payments for the first two years), the lender can treat that $75,000 as seller equity left in the deal. That means the buyer would only need to bring the remaining $25,000 in cash to reach the total equity requirement. In practice, this shifts the buyer's immediate cash burden significantly and often makes deals workable that otherwise would not close.

Why lenders accept standby seller financing:

- It shows the seller is invested in the deal's success and not fully exiting risk.

- Standby often reduces immediate payment pressure on the new owner while SBA loan amortization begins.

- When structured correctly and documented per SBA rules, standby notes meet the spirit of an equity injection.

Important cautions: the SBA has rules about the form, documentation, and subordination of seller notes. Any standby must be clearly documented, subordinated appropriately, and disclosed up front to the lender and underwriter. Work with counsel and your lender to ensure the note meets SBA expectations.

Photo by Giorgio Tomassetti on Unsplash

Alternative Equity Sources: Other Ways to Meet the Injection Requirement

If seller financing isn't available or sufficient, there are several alternative ways to source your equity injection. The key is choosing options that underwriting will accept and that the business cash flow can support.

Common alternatives include:

- Home equity lines or HELOCs on rental properties: If you personally own rental properties with equity, you can often secure a HELOC or equity loan and use that cash as your injection. Underwriting will want to see the payment impact and ensure the combined debt service is sustainable.

- Asset-based loans against equipment: If the target business or you personally own substantial equipment, you can obtain an asset-based loan secured by that equipment and use proceeds as your injection. Again, lenders will look at payment obligations and residual collateral value.

- Bringing in a minority partner: A partner who takes under 20% ownership can inject cash that counts as equity. Structuring and ownership percentages matter here — make sure ownership and injection are consistent with SBA rules.

- Personal funds or investor capital: Straight equity from buyers or investors is always acceptable when properly documented.

When using alternative sources, two things matter most to lenders: documentation and cash flow. Document the source of funds, the terms (if borrowed), and show how the business will handle any additional payment obligations. If the equity injected increases monthly debt service, underwriters will make sure the pro forma cash flow covers those payments.

Working with Your Banker: Communication Is Everything

One theme I stress with every client is: tell the banker your strategy early and clearly. If you plan to use a HELOC, equipment loan, or seller standby to satisfy equity injection, disclose it upfront so the lender can evaluate payment impacts and documentation needs. Surprises during underwriting slow deals and can cause rejections.

Photo by Giorgio Tomassetti on Unsplash

Practical steps to take with your banker:

- Explain the full capital stack — what the SBA loan will cover, what the seller is providing, and what cash or outside loans fund the remainder.

- Provide commitment letters or term sheets for any outside financing (HELOC, equipment loan) so underwriting can assess obligations.

- Confirm the seller standby structure in writing and obtain legal documents showing subordination if necessary.

- Ask the lender whether they accept substitution of collateral in your scenario — many do not — and request underwriting guidance in writing.

Remember: it's not just about getting the money; it's about convincing an underwriter that the capital stack is stable, compliant with SBA rules, and sustainable for the business cash flow.

Practical Checklist & Best Practices for Collateral and Equity Injection

Use this checklist as you prepare your SBA 7(a) application:

- Confirm the lender's view on substitution of collateral — most banks prefer not to use it.

- Prefer seller financing first. If the seller will carry a full standby, document it and show subordination.

- If using personal or outside financing (HELOC, equipment loan), get term sheets and calculate payment impact on cash flow.

- Consider bringing a minority partner (under 20%) to supply equity if necessary.

- Provide clear source-of-funds documentation at closing for every dollar of equity.

- Work with experienced counsel or a broker who understands SBA standby rules and lender preferences.

These best practices reduce underwriting friction and increase the probability of approval while positioning your deal for a smooth close.

Common Questions (Short FAQs)

Can substitution of collateral be used? The SBA allows substitution in guidelines, but many banks choose not to accept it. It's not a reliable plan unless your specific lender agrees in writing.

Does a seller standby always count as equity? When properly structured — subordinated and documented — full standby seller notes are commonly accepted as equity by SBA lenders. Get the terms and subordination documented and disclosed early.

Can I use a HELOC on rental properties? Yes, you can use a HELOC or home equity loan as your injection, but underwriters will test the payment impact. Make sure the combined debt service still fits within your cash flow.

Can a partner under 20% be the source of equity? Yes, a minority partner can supply equity injection funds. Ensure ownership percentages, documentation, and SBA rules are respected.

Conclusion — Next Steps to Structure a Winning SBA 7(a) Application

Structuring collateral and equity for an SBA 7(a) loan is as much about storytelling and documentation as it is about math. Start with seller financing whenever possible, explore alternative equity sources like HELOCs or equipment loans, and communicate your plan early with the banker and underwriter. That transparency and preparation dramatically improves your odds of approval.

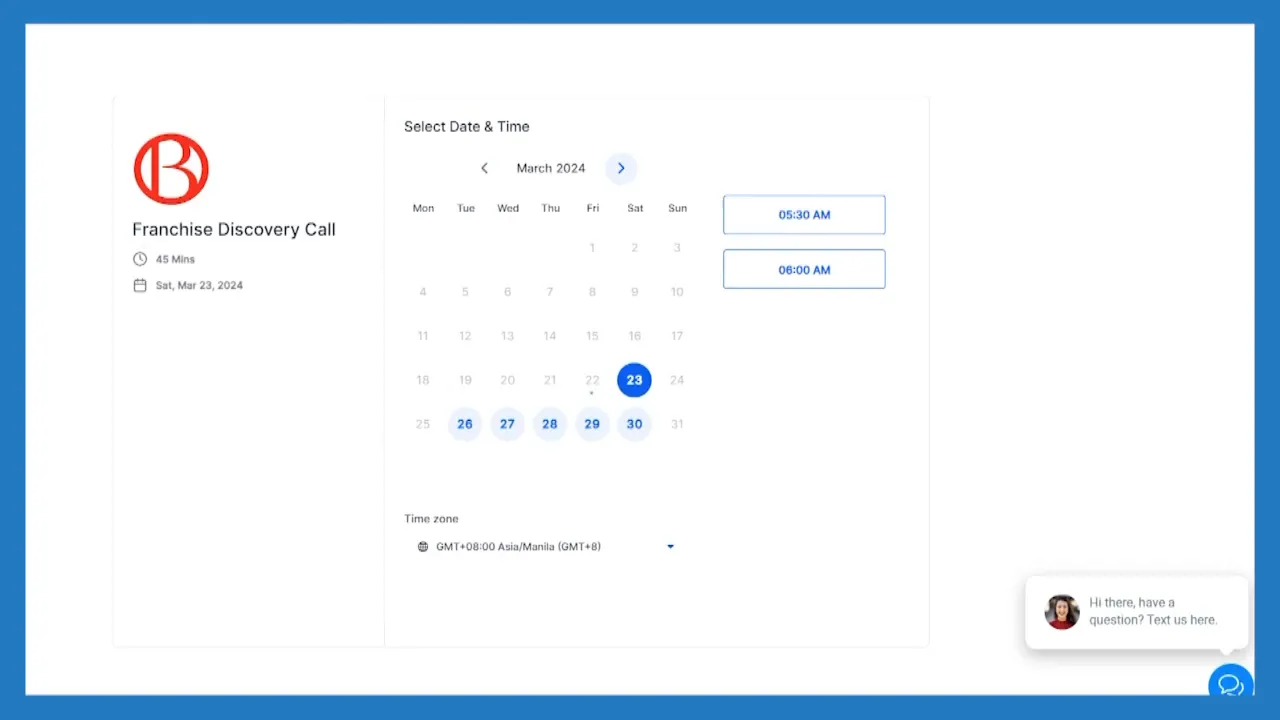

If you want help mapping a strategy for your acquisition or financing plan, schedule a discovery call at bookwithbeau.com and we can walk through options tailored to your situation. If you're searching for businesses or franchises to acquire, visit franchisresallistings.com to get customized listings delivered weekly.

Thanks for reading — I hope this gives you clarity and practical next steps. As a Business Ownership Coach | Investor Financing Podcast, my goal is to simplify financing so you can focus on running and growing your business.