I'm Beau Eckstein — your Business Ownership Coach | Investor Financing Podcast host — and today I'm breaking down the October SBA 504 rate update and what it means if you're buying, refinancing, or expanding with commercial real estate or a franchise. As a Business Ownership Coach | Investor Financing Podcast creator with 20+ years in lending, I want to make sure you understand the numbers, the policy drivers behind them, and the practical next steps to lock your best deal.

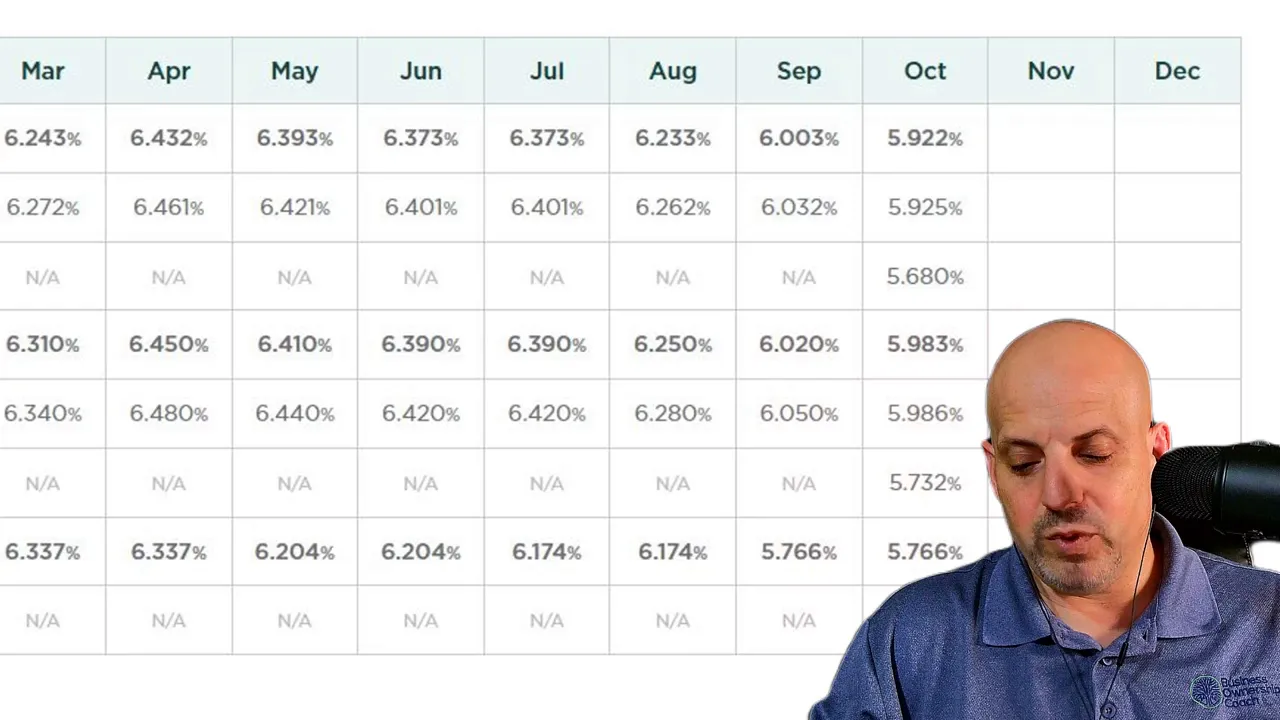

Quick snapshot: The current SBA 504 rates (October)

Rates moved lower again in October. Here are the headline fixed debenture rates you need to know:

- 25-year SBA 504 debenture: 5.92%

- 20-year SBA 504 debenture: 5.98%

- Made in America manufacturing rate (select NAICS codes): as low as 5.68%

That manufacturing rate represents roughly a 20 basis point discount from the standard debenture — and, in many cases, the upfront fee (about 0.5%) is being waived for qualifying manufacturing projects. If you're in manufacturing or considering acquiring a manufacturing business, these incentives can materially reduce your cost of capital.

Why the Made in America Initiative matters for your financing

The “Made in America” initiative is targeted: if your business operates in a qualifying NAICS code (manufacturing sectors), your SBA 504 borrowing cost can be lower and fees can be reduced or waived. This is not a universal rebate; it’s specific to eligible manufacturers. For businesses that qualify, this can be an important differentiator when comparing loan structures.

As your Business Ownership Coach | Investor Financing Podcast guide, I often emphasize two points about these incentives:

- The interest savings (e.g., ~20 basis points) compound over a 20–25 year loan term and can translate into meaningful cashflow improvement.

- The upfront fee waiver also reduces out-of-pocket costs at closing or the amount rolled into the loan, which helps preserve working capital for operations or renovation capex.

Photo by Recha Oktaviani on Unsplash

What’s driving these lower long-term SBA rates?

Inflation readings and Federal Reserve policy are the primary drivers of long-term SBA debenture rates. When the economy shows signs of weakness or “shifty” behavior, markets often price in lower long-term rates as part of a broader easing environment. In recent weeks, we've seen residential mortgage rates edge lower and the Wall Street Journal prime decline from 7.5% to 7.25% — a meaningful signal for borrowing costs tied to the 7(a) program.

My expectation, based on current macro indicators, is a downward trend over the next 12–18 months — though the exact magnitude and timing remain uncertain. Lower macro interest rates tend to push SBA 504 debentures down as investors demand less yield on the pool of bonds that back these loans.

Loan size changes and opportunities for manufacturers

One notable policy shift that's worth highlighting: for certain manufacturers under the Made in America initiative, loan proceeds that were previously capped at $5 million could be eligible for higher maximums — potentially up to $10 million on the 7(a) side. For 504 loans, the 504 portion functions as a second loan in a first-and-second structure, and larger caps mean you can finance bigger projects under the SBA umbrella.

Keep in mind: policy changes create opportunity, but banks and CDCs (Certified Development Companies) have to operationalize these updates. That means availability of larger loans will vary by lender appetite, local market conditions, and the bank’s willingness to adopt the program at scale.

504 vs 7(a): Which is better for real estate-heavy deals?

My short answer: 504 loans typically remain more attractive for real estate-heavy deals because of pricing and term structure. The 504 program offers long-term, fixed-rate financing with competitive pricing on the debenture-backed portion. However, the tradeoffs include:

- Higher upfront fees (though often wrapped into the loan)

- Longer or more structured prepayment penalties

- A two-step underwriting process (bank + CDC/SBA) instead of a single lender underwriting for 7(a)

If you expect interest rates to fall substantially in the near future, a 7(a) with a potentially shorter term or an easier prepayment profile might make sense. But for borrowers focused on long-term fixed-rate real estate financing, a 504 is still a compelling choice.

The government shutdown: timing risk and what it means for your loan

One operational risk I always flag: government shutdowns. If the SBA or CDC offices are closed or operating at limited capacity, loans that do not yet have a loan number may experience delays. Loans that already have a loan number and are far along in the process can often still fund, but new submissions or deals in earlier underwriting stages could be postponed.

My advice as your Business Ownership Coach | Investor Financing Podcast host: don’t wait on the sidelines. Get your documentation ready and submit early. Even if SBA underwriting pauses temporarily, having a fully packaged file with the bank and CDC positions you to move quickly once normal operations resume — and be mindful that reopening periods often bring a backlog that slows processing.

Photo by Giorgio Tomassetti on Unsplash

Practical steps to lock in the best deal this month

If you’re sitting on the fence, here’s a practical checklist to act on now:

- Get your documents in order: financials, tax returns, business plan, property information, and NAICS classification if you’re claiming manufacturing incentives.

- Engage your bank and CDC early: have the bank underwrite and prepare the SBA package. Even if the SBA is temporarily offline, the bank and CDC can still begin their work.

- Evaluate both 504 and 7(a) options: look at the blended cost, fees, prepayment penalties, and long-term cashflow impact.

- Consider locking or reserving rates if your lender offers that option and it aligns with your project timeline.

- Plan for closing contingencies: expect potential delays if government offices are impacted, and build a buffer into your timeline.

Acting now positions you to capture attractive debenture pricing and to avoid losing runway in a competitive financing environment. Markets shift, but opportunity favors prepared action.

How I can help — and next steps

If you’re planning to acquire or refinance property under the SBA 504 program, now may be a window to secure favorable long-term financing. As your Business Ownership Coach | Investor Financing Podcast host, I help entrepreneurs assess timing, lender fit, and loan structure so you can choose the right program for your project.

Whether you’re pursuing a franchise, buying a commercial building, or expanding a manufacturing operation that could qualify under the Made in America initiative, get your file ready and reach out for a strategy call. Even if the SBA pauses underwriting temporarily, proactive preparation gives you an edge when volume ramps back up.

Conclusion — seize the moment, but plan for contingencies

Photo by Giorgio Tomassetti on Unsplash

To recap: October brings lower SBA 504 debenture rates, with special advantages for manufacturing under the Made in America Initiative. The macro backdrop suggests rates could trend lower over the next 12–18 months, but operational risks like government shutdowns can create timing challenges. If you want long-term, real-estate-friendly financing, 504 remains compelling — but always weigh fees, prepayment penalties, and your outlook on future rates.

As your Business Ownership Coach | Investor Financing Podcast host, I’m here to help you interpret these changes and act decisively. Get your documents ready, talk to your bank and CDC, and let’s build a financing plan that fits your long-term business goals.